Lifetime allowance

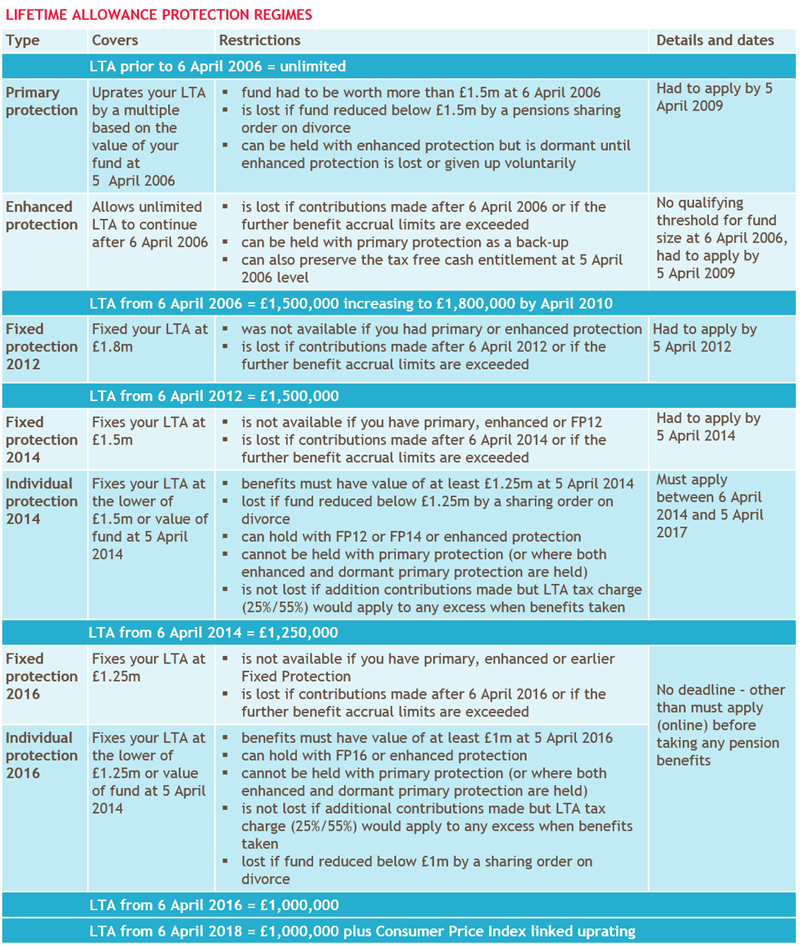

Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. Individuals whose total UK tax relieved pension savings are.

9fvnnopwnsuggm

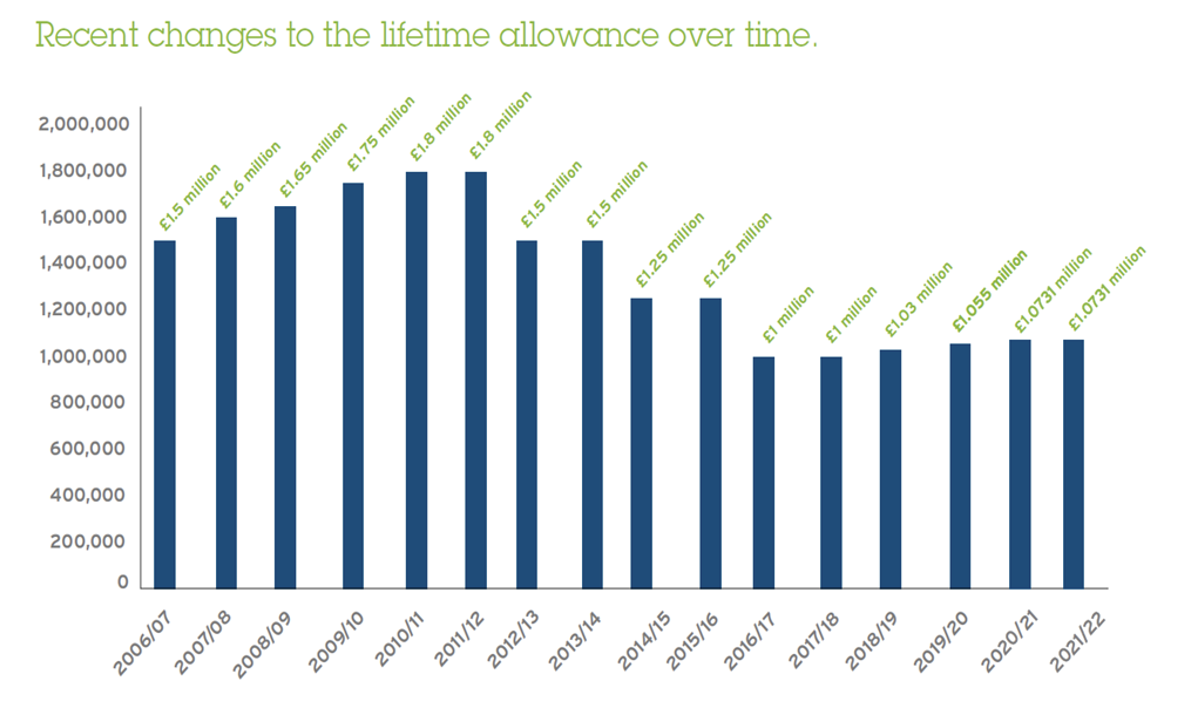

The lifetime allowance limit 202223 The 1073100 figure is set by.

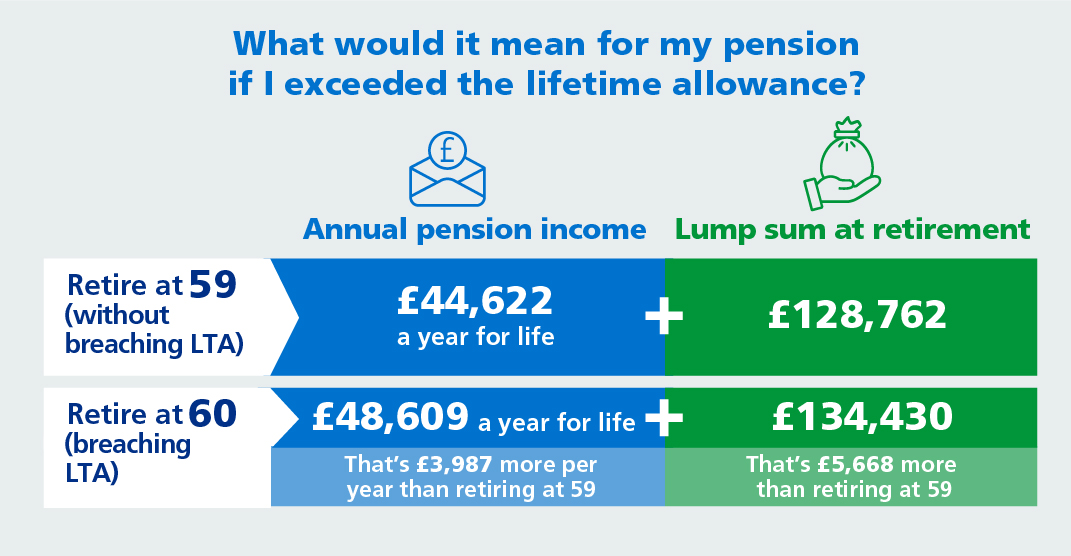

. If you take the excess as a lump sum its taxed at 55. Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply. Web Pension Lifetime Allowance changed in April 2016 and action needs to be taken by people with pensions likely to be greater than 1000000 so that they can avoid having taxes.

Web The Lifetime Allowance LTA is the overall amount of pension savings that you can have at retirement without incurring a tax charge. Web 23 hours agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax.

Web 1 day agoThe Lifetime Allowance penalised those who had invested diligently and sensibly during their working life and discouraged people from putting money into. Professional Document Creator and Editor. You can save as much as you want to in your pension - but if it exceeds a total amount you could be hit with a.

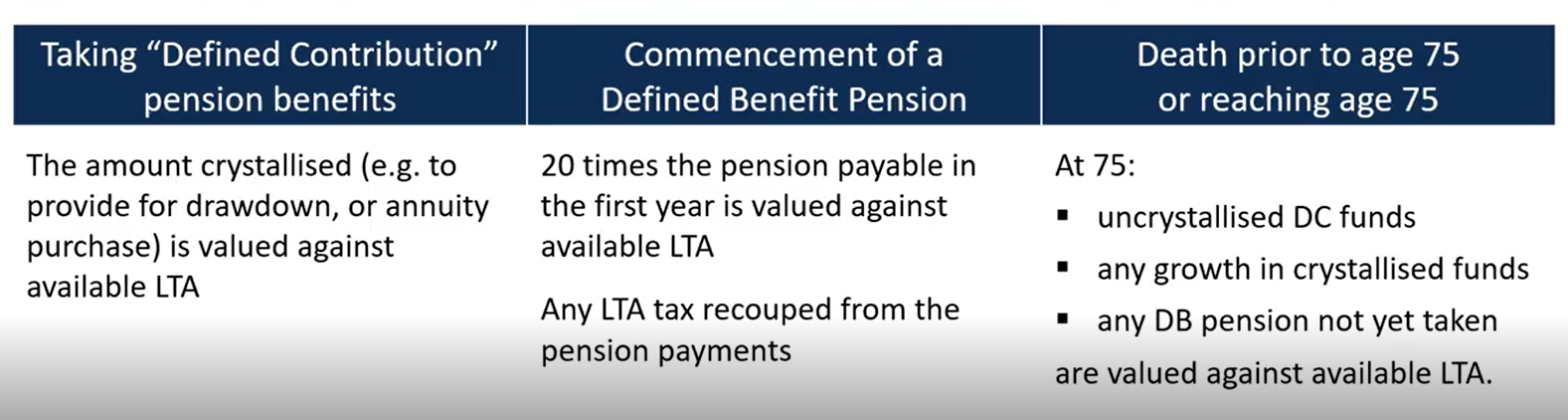

Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being. Web A lifetime allowance charge can only apply when the value of an individuals pension savings at a benefit crystallisation event is over the lifetime allowance. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge.

Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax. Ad Edit Fill eSign PDF Documents Online. Benefits are only tested.

Web 2 days agoCurrently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m. Web For pensions the Lifetime Allowance LTA is the overall limit of tax privileged pension funds a member can accrue during their lifetime before a Lifetime Allowance tax. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here.

Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. Each time you take payment of a pension you use up a percentage of. Web Charges if you exceed the lifetime allowance Lump sums.

Web 1 day agoCurrently the lifetime allowance caps the total amount a person can save in a pension without having to pay an additional tax charge. Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year. Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge.

Web The current lifetime pension allowance LTA currently stands at 107m meaning those with money in their pension pot incur tax only after that threshold has. It means people will be allowed to put. Mr Hunt will outline his Spring.

Under previous plans the. Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected. The current standard LTA is 1073100.

The other is the annual allowance and. The government limit is set at 1073100. Web What is the pension lifetime allowance in 2022-23.

Your pension provider or administrator should deduct. Web The Lifetime Allowance LTA is the limit on the amount you can take from your pension savings before youre charged tax.

Nhs England Understanding The Lifetime Allowance

Should I Fear The Lifetime Allowance Legal Medical Investments Financial Advisers

Qgmeyopx26cc3m

Is A Further Reduction In The Lifetime Allowance On The Cards Melbourne Capital Group Insights

How To Pass The Cii R04 Demystifying The Annual Allowance And Lifetime Allowance

Lifetime Allowance Explained How To Avoid Tax Bills On Pension

The Lifetime Allowance Back To Basics Professional Paraplanner

How To Manage The Lifetime Allowance To Your Advantage Netwealth

2azqlfpzl V1mm

Should I Worry About The Lifetime Allowance James Hambro

Iap5vvuzauejlm

Ruaz0igmqqkdom

Pensions Protecting Your Lifetime Allowance Bdo

Cefqvtv5jxgrmm

Pension Lifetime Allowance Explained St James S Place

Saakcf Fv3knhm

Uk Shadow Chancellor Set To Overturn Lifetime Allowance Abolition International Adviser